The Scheme is an open-finished value plot transcendently putting resources into enormous top stock. The venture target of the Scheme is to accomplish long haul capital increase by putting resources into a differentiated portfolio overwhelmingly comprising of value and value related protections of Large Cap organizations including subsidiaries.

Pros and Cons of Axis Bluechip Fund

With a 7-year return of 14.86%, the store has beaten the benchmark record (12.33%) and the class normal (12.21%). This Scheme has an amazing reputation for out-execution. It accentuates on quality and development in its stock picks, favoring organizations with improving incomes and higher profit perceivability. While the Scheme will, in general, keep up a smaller portfolio, it has eliminated the number of stocks forcefully as of late in light of the predominant economic situations where just some select stocks are progressing nicely. The reserve has demonstrated to a trustworthy offering in this classification.

Various Investment Facts of Axis Bluechip Fund

• It is the main enormous top reserve which has no mid-top holding. Be that as it may, it is zero little top holding is a typical enormous top store include.

• Axis Bluechip reserve needs the third most amazing commitment and cash holding in the class, mirroring its robust moderate position. Investment Strategy of Axis Bluechip Fund

• The reserve transcendently puts resources into value and value related instruments of enormous top organizations with solid development and supportable plans of action, while overseeing hazard.

• The store holds a minimal arrangement of 25 stocks, with an accentuation on quality and development. Its portfolio is developed using the base methodology, concentrating on gratefulness capability of individual stocks from an essential viewpoint. It utilizes a ‘Reasonable worth based’ investigate procedure to break down the development capability of stocks. The stocks are deliberately chosen to incorporate organizations having strong plans of action and getting a charge out of a feasible upper hand when contrasted with their rivals.

• Axis Bluechip Fund‘s portfolio is overseen effectively to give financial specialists an arrangement of solid development organizations. The store intends to use a comprehensive hazard of the boarding procedure to oversee chance related to putting resources into value markets.

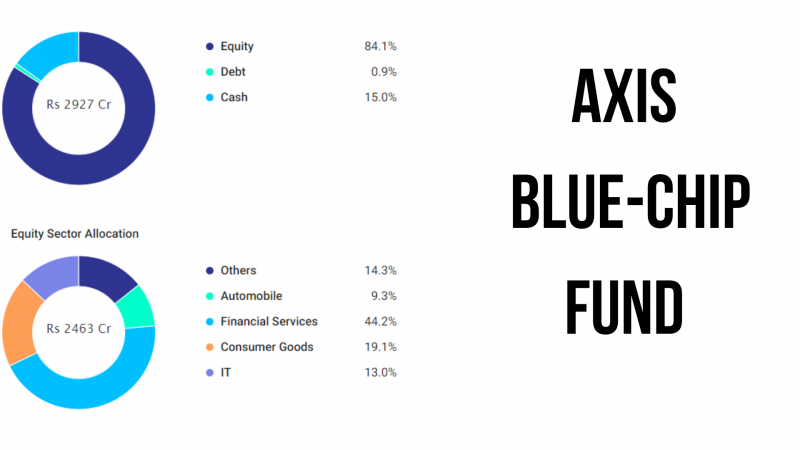

• Axis Bluechip Fund puts 80-90% of its holding in huge top stocks. Even though the plan has the adaptability to put up to 20% in little and mid-tops it abstains from taking any presentation to bring down market tops. The money and obligation holding of the reserve is in the scope of 10-20%. The store has repelled itself from the mid and little top portion in the present schedule year, which could be because of higher instability seen in this space in the course of the last one and a half years.

The best 10 stocks comprise 61 of the absolute possessions and are engaged towards the Banking and Finance part. HDFC Bank beat the rundown with a designation of 9.5%, trailed by Bajaj Finance and Kotak Mahindra Bank with a distribution of around 9% each. This is intently trailed by TCS (7.7%) and ICICI Bank (5.8%). Different stocks in the best 10 possessions have a distribution in the scope of 3.5%-4.7%.